Learn from History or Repeat It!

Nearly ninety years after the fact, there is still a great deal of controversy about specific causes of the Great Depression, but the following factors are rarely discounted in any way:

The Fed increased money supply and kept interest rates low.

- This caused a rapid expansion where much of the surplus money supply fueled already over-heated stock market and real estate bubbles.

- Money supply increased an unprecedented 61.8% between 1921 and 1928.

- By Black Tuesday, the stock market had been on an 8-year bull run, setting new highs throughout the final year.

Hoover’s Administration took a protectionist stance by implementing the Smoot-Hawley Tariff, tightening immigration, and initiating a massive public works program.

- Tariffs caused retaliation from three dozen countries, imports fell 60% and outbound international trade declined 66%, further exacerbating worldwide economic conditions.

- Tightened immigration laws meant to keep low-skilled workers from flooding the labor market failed, due to administration-endorsed increased wages and high prices that prevented American workers from taking the jobs.

- Massive public works programs designed to reduce unemployment, added billions to the national debt.

Loose credit and an increased money supply fueled robust growth, as well as the euphoria of the Roaring Twenties, but the country was unable to sustain the government’s artificially-induced levels and with global trade effectively decimated, the U.S. economy sank from a recession into a depression.

The Fed’s inaction over the past 5 years has interest rates well below an appropriate level and the quantitative easing programs have flooded the money supply. The current administration intends to withdraw from or renegotiate trade agreements, implement tariffs, build walls and foster an isolationist/protectionist stance. Further, they intend to tighten immigration, making it more difficult for foreigners to fill low-pay labor positions, while at the same time raising the “minimum wage.” A trillion dollar infrastructure spending plan has yet to be presented, but is in the works. The eight-year bull market that ended on Black Tuesday saw some of its greatest gains in the year prior to the collapse. The current bull market turned 8 years old on March 9th. As I write this article, the Dow Jones Industrial Average is up 25% from a year ago (hitting an all-time closing high the day before yesterday) and real estate prices have almost completed a return to pre-2008-collapse values. Both bubbles are once again fully intact.

Every major factor that was in place prior to Black Tuesday is in place again today!

I have only two things to say about that:

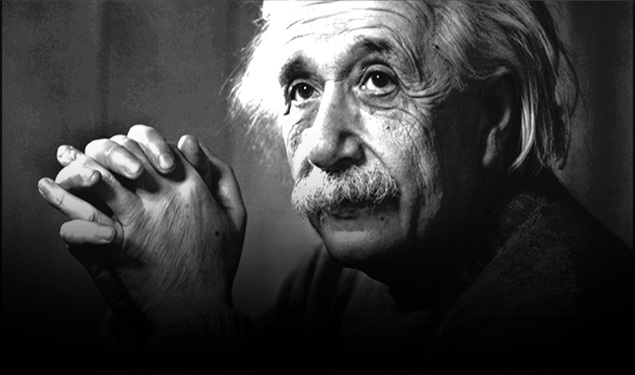

“Insanity is doing the same thing over and over again and expecting different results.”

-Albert Einstein

“Those who do not learn from history are doomed to repeat it.”

-George Santayana