Gold is Financial Portfolio Insurance

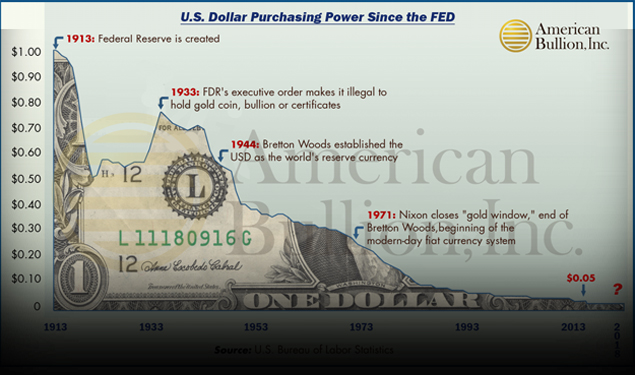

You own a home, so you have homeowners insurance. You live in a low-lying area of the city, so you also have flood insurance, for circumstances not covered by your homeowners insurance. You own a car, so you have auto insurance. You have an entire family covered with medical insurance. It’s not cheap, but you realize the importance. Nevertheless, if you’re like a great deal of Americans, you have little to no coverage on your greatest asset, your financial portfolio. Many say, “But I’m well diversified, I don’t have all my eggs in the same basket. If stocks do poorly, I’ll make it up in treasury notes or real estate.” But what these people fail to understand is that all of those assets trade exclusively in U. S. dollars. If our fiat U.S. dollar (which has lost 93% of its value in just over a hundred years) were to become substantially more worthless tomorrow, all of those “diversified” investments would suffer.

The type of insurance that could protect that entire range of assets previously discussed is gold. Gold has served as a dependable store of value for millennium. Someone in the crowd inevitably says, “I own gold and silver ETF’s, so I’m covered.” But again, what they too fail to realize is the fact that even though an ETF owns gold, fund participants are way down the food chain when cataclysmic economic events occur. Owners of physical precious metals, on the other hand, have immediate and direct access to a stable and globally accepted currency (that does well, especially when the dollar doesn’t).

With very little fanfare from the media, the dollar was essentially lobotomized last December. For a U.S. guarantee of military protection in 1974, King Faisal (King of Saudi Arabia) made the dollar the premier global reserve currency. However, unbeknownst to most, two events occurred last month that leave the dollar looking alive, but realistically dead on a global front. The first cut was made by China, who now has more than twenty countries signed with the Shanghai Energy Exchange, for the purpose of trading oil in Yuan/Gold, rather than dollars. The list includes Russia, Iran, and India, just to name a few. The paralyzing cut was made when the current King of Saudi Arabia agreed to purchase and install the Russian S-400 defensive missile system. So essentially, though no official announcement has been made, the U.S. dollar is globally “dead on the table.”

In summary, Saudi Arabia has no further reason to entertain the hegemony wishes of the United States. Further, China, Russia, Iran and others, who have had their fill of U.S. sanctions and saber-rattling, will be happy to announce the discounting or replacement of the dollar as the premier global reserve currency, most probably at a critical financial juncture, just to add a little salt to the wound. So a U.S. market crash or other financial calamity at this point, could be further exacerbated by a cacophony of negative economic conditions, previously shielded by the dollar’s hegemony standing. Don’t get caught without a chair when the music stops! There won’t be time to fix it once it breaks.