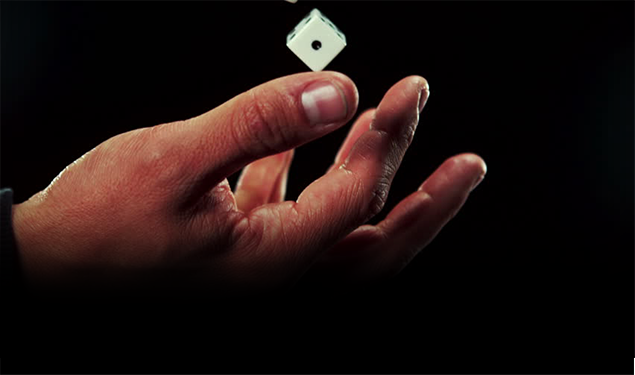

The Die Is Cast!

Now that the Chinese Yuan has officially been added to the International Monetary Fund’s basket of global reserve currencies with Special Drawing Rights (SDR), the door has indeed been opened to allow for the displacement of the U.S. Dollar. If you legitimately put yourself in the shoes of a citizen from any other country, I believe you’d find yourself hard pressed to defend the benefits afforded the U.S. Dollar for all of the past eighty years. Based on our ability to support global economic sanity, security and stability, particularly in the Forties, I certainly believe that we earned those benefits. But to believe that they are somehow a permanent endowment is presumptuous, arrogant and even insolent.

Beginning with the insipid decision to take the Dollar off the gold standard in 1971, the U.S. has managed to mismanage every element that validated the global trust placed in its care. I could enumerate a litany of such blunders since, but suffice it to simply examine what the world is being asked to digest within the confines of our current election. Regardless of who’s elected, what have you seen that would instill any type of confidence in the U.S. ability to continue in the role of “World Leader?” One choice allows us to isolate ourselves and exacerbate others, while the other provides the opportunity to “fine tune” an already out of control spiraling government spending spree, which increased U.S. debt by $1.4 trillion in the past year alone.

Meanwhile, the Euro continues to reel due to its collection of weak economies and new ramifications generated by Brexit, the British Pound is collapsing under its own isolated weight, the Yen still suffers from a string of ineffective QE attempts and in spite of its newly elevated position, the Chinese Yuan finds itself wallowing in value at levels near a six year low. So in spite of all its flaws, the Dollar again finds itself as the strongest member in the IMF’s SDR basket. By all analysis, it seems akin to being announced the winner in a monkey shit fight.

So in review, regardless of all its faults, the U.S. Dollar remains the dominant force in a field of flounders. A simple question begs to be asked. How long before the IMF stops considering and actually takes action regarding implementation of an IMF-sponsored One World Currency? A majority of countries could benefit from a more even playing field. Japan, Britain and Euro-countries would suffer, but survive (at least those that would anyway), but the United States could suddenly be deprived of benefits that only the oldest Americans realize as preferential and truly appreciate, due to “knowing” the difference. So do yourself a favor and protect your assets with physical precious metal ownership. It’s the only true universal currency. All of human history can’t be wrong.