Is the Writing on the Wall? Turkey Seems to Think So!

Thanks to the success of their own downward manipulation, global central banks, as well as the Fed have been buying up gold at sustained lower prices. But Turkey, a huge net seller during the last 6 months of 2016, suddenly has a renewed passion for ownership of the yellow metal too, such that, the country has increased its reserves by more than 7% in the past three months alone. Belarus, Kazakhstan, and Russia have been acquiring gold too, but not at Turkey’s feverish pace. Meanwhile, Germany has become a net seller over the same three month period. There’s no obvious explanation for these activities, but it’s hard to imagine that anyone is realistically trying to time the market, unless there is more of a “coordinated manipulation” than anyone had imagined.

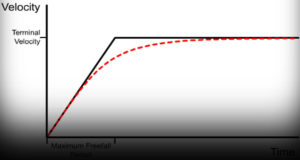

Some analysts are even suggesting that there was a conspiracy on the part of Turkey and other countries to participate in the downward manipulation of gold prices. Turkey sold more than 3 million ounces of gold last year between June and December, before once again returning to the buyer’s side in earnest this year. Turkey’s purchases this year are at substantially lower prices and seem to have timed the market well, as gold has bounced off its lows and has now moved above its 200-day and 50-day moving average, which is technically a sign of strength. The activity is all the more impressive when you consider that it’s taking place in the middle of the typically inactive summer doldrums.

The summer doldrums usually manage to slow the rise of gold, but slowing global economies, an impotent U.S. administration, and an over-heated bull stock market are combining to provide an early end to the typical summer cycle. And another economic pressure that the media doesn’t appear to be aware of is the upcoming debt ceiling debate. This is going to be a mega blowout that will probably put the WWF to shame. With all the white noise about Russia, investigations, and healthcare, the debt ceiling increase has been sidelined, but that’s a very temporary condition and when it gets loose, it’s going to steal the spotlight and leave a massive wake of economic carnage. Our long-in-the-tooth bull market may become the first dramatic casualty.

There are many theories about market movements and many have validity, but the bottom line is that the precious metals market is relatively very small. If all the gold ever mined from the Earth were distributed equally to every person on the planet, an individual’s share would be measured in single digit grams. Combine that fact with today’s stop-loss order practices, massive institutional orders, and program trading techniques and you’ve got all the ingredients for nearly instantaneous and dramatic market movement. Individual investors should immediately take advantage of today’s availability. Today’s prices are just an exponentially wonderful bonus.