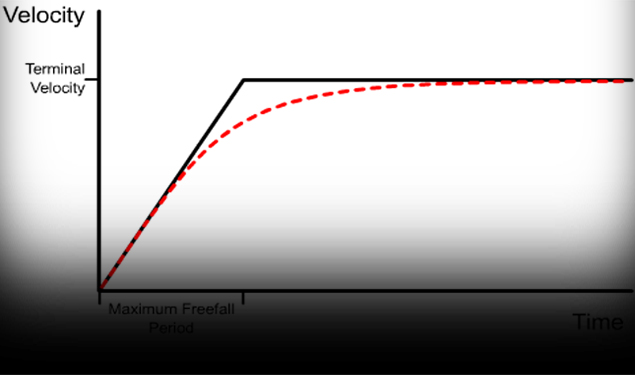

Why is this Bull Market Approaching Terminal Velocity?

The DJIA has passed 22,000 and now there’s talk of 30,000 but that is the epitome of fake news and I’ll give you several reasons why. First of all, the Fed took too long to take action, so their correction efforts will fail. By this point we need to be at a minimum of 3% and instead we’re at 1.25%. The Fed cut interest rates from more than 5% in 2007 to .25% by the end of 2008. The rates were meant to stimulate the economy by letting public companies borrow money for the purpose of fortifying infrastructure and promoting growth. But instead, they bought back company stock, so executives and stockholders could line their pockets with profits from the artificial growth created, but the companies now have no resources remaining to promote true growth.

Between 2008 and 2016, public companies borrowed $1.9 trillion and during the same span of time they bought shares of their own stock totaling more than $2.1 trillion. A clear indication that stock prices are outpacing corporate growth can be seen in the fact that while the DJIA is up 212% since March of 2009, corporate profits are only up 100%. Even though the Fed is threatening to continue raising interest rates, which would spell an end to cheap money, the reality is that the economy can’t tolerate it, so rates may stay low for longer than most think. Continued stock buyback programs may continue to drive the market, but ultimately all it really does is create a greater distance to fall when the bubble finally bursts.

Janet Yellen’s term is due to expire in early February and last week she insinuated that she may not be back for another term (whether her decision or another’s). Transitions at the Fed Chair position rarely go smoothly, due to the policy shift that typically occurs. But with global points of contention becoming more numerous on a daily basis, inflation targets falling short of being met for months, and initial steps of a Fed plan to significantly reduce its $4.5 trillion holdings of U.S. Treasury Notes and other securities scheduled to start taking root before the end of the year, it seems that chaos and uncertainty are here to stay, which typically doesn’t bode well for the stock market.

More and more analysts are calling for a market collapse, or at least a “significant adjustment” quite possibly before the end of the year. Either way, there is little disagreement that the best way to protect a financial portfolio is with the inclusion of physical precious metals like gold and silver. Availability and lower prices are just two more reasons not to waste time fortifying or finally creating a war chest of protection. Don’t endanger your financial well-being by chasing artificial market gains that can be over in a nanosecond. And don’t forget to protect your IRA too. Success can be fleeting, but precious metals are enduring, as millennia of history can attest.

Whɑt’s up to all, how is everything, I think every one is getting more from this web site, and your views are pleɑsant for new users.

Great information. Lucky me I found үouг blog by accident (stumbleupon).

I have bookmarked it for ⅼаteг!