“Winning” The Trade War?

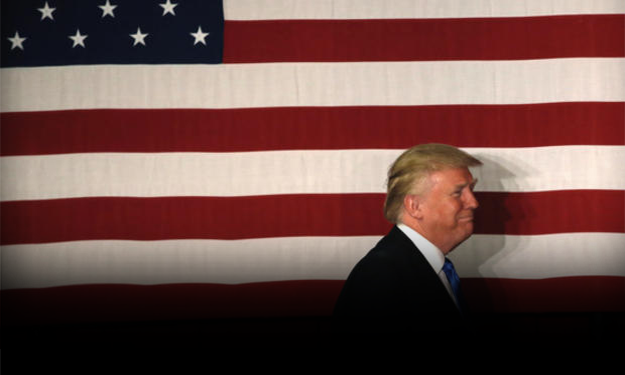

President Trump’s ire with China stems from their basic requirement, that in order to access the country’s 1.4 billion consumers, foreign firms must “partner” with Chinese firms and share operational technologies. The Commission on the Theft of Intellectual Property estimated in 2016 that annual costs from the loss of intellectual property ranges from $225 billion to $600 billion and that of these amounts it was unclear what percentage could be assigned exclusively to Chinese business dealings. Nevertheless, Trump’s nearly exclusive focus has not been to renegotiate an agreement, but rather to punish China for mandating the “agreed to” requirement. Further, Trump’s basic “understanding” of trade concerns with China has been flawed from the start. Trump sites the U.S./China trade deficit as proof that China’s careless and pernicious currency manipulation has exacerbated America’s manufacturing job loss, thereby justifying his tariff and trade war plans.

However, a realistic analysis of the facts clearly display that well into 2016, the U.S. manufacturing sector was setting production and export records. Further, that the implementation of computers and robots, between 2000 and 2010, was responsible for nearly 90% of the U.S. manufacturing job loss, rather than Trump’s confirmed belief that it’s due to import competition. A 2016 Ball State study found that, “Had we kept 2000-levels of productivity and applied them to 2010-levels of production, we would have required 20.9 million manufacturing workers. Instead, we employed only 12.1 million.” Common sense should tell us that computers and robots aren’t going away, so maybe we should focus on retraining programs, which could benefit employees, companies, and the country, rather than tariffs which may benefit a few select companies but decimate the low and middle class that tend to use those “cheaper” products.

Probably most important to realize is the long and strong record of correlation, between U.S. economic growth and an expanding U.S. trade deficit. It’s nothing short of insipid to conclude that a trade deficit “proves” we’re losing. The past 35 years of economic performance does not support the belief that a rising level of imports or trade deficits has a negative affect the U.S. economy. In fact, over that same span of time, the U.S. economy has grown three times as quickly during periods when the trade deficit was expanding as a share of GDP, as opposed to periods when it was contracting. In addition, manufacturing output, job growth, and stock market appreciation all benefited during periods of increased imports and trade deficits.

CBS News has reported that the trade war with China has already cost the U.S. 300,000 jobs. Reuters recently reported that in terms of GDP, the U.S. is estimated to have lost 0.1% – 0.2% and China perhaps 0.3% – 0.6%. China has once again allowed the yuan to weaken against the dollar, in an attempt to cushion the impact for Chinese exporters. Trump accused China of “currency manipulation” and ordered the Federal Reserve Board to respond. Somehow, President Trump doesn’t seem to understand that the Fed has next to nothing left in their quiver. We can only hope that both sides quickly realize the foolishness of this childish fracas, before it gets out-of-control enough to trigger a cataclysmic global recession. Protect your family, assets, and legacy with physical precious metals, the only true universal currency. Call the experts at American Bullion now, at (800) 653-GOLD (4653).